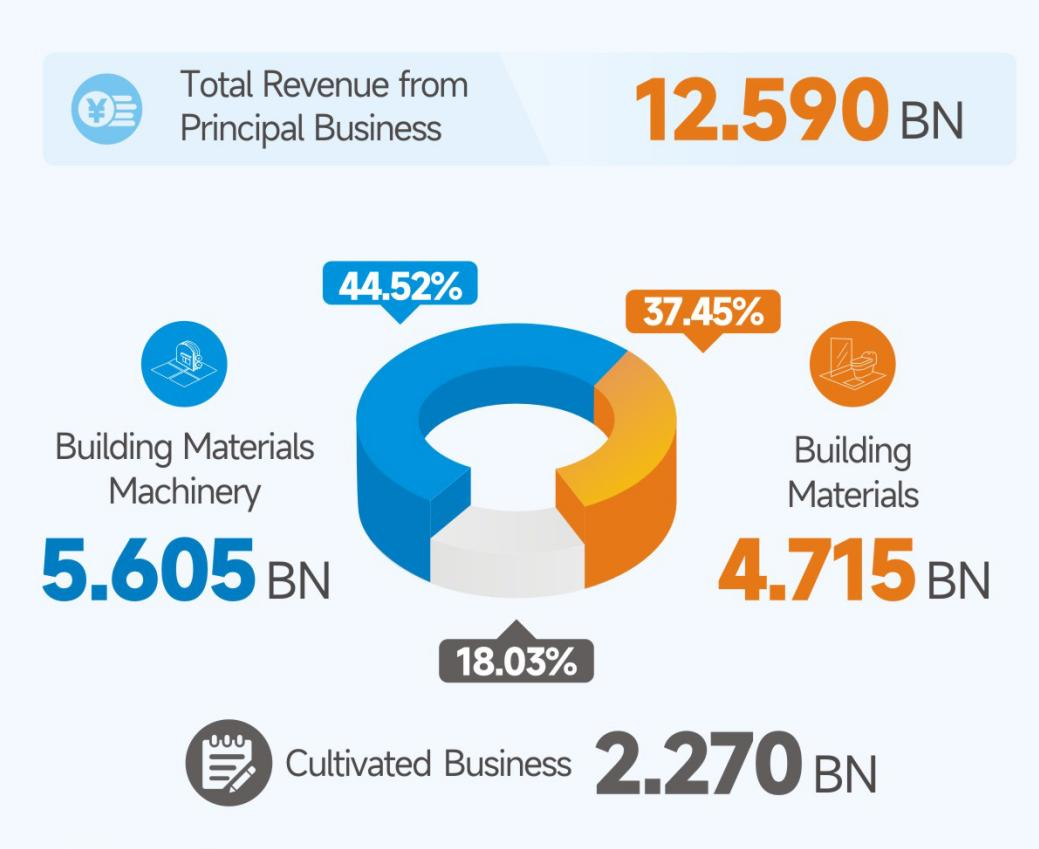

Today, KEDA Industrial Group (600499.SH) released its 2024 annual report, reporting an operating revenue of RMB 12.6 billion, a year-on-year increase of 29.96%. The company achieved a net profit attributable to shareholders of the listed company of RMB 1.006 billion, and the net profit attributable to shareholders of the listed company excl. non-recurring profit or loss stood at RMB 921 million.

KEDA Industrial Group continues to implement its globalization strategy, deepening its efforts in market expansion, product innovation, and cost optimization, showcasing solid business capabilities.

Meanwhile, in line with its tradition of high dividend payouts. The company has proposed a cash dividend of RMB 2 per 10 shares (tax-inclusive), totaling RMB 372 million. The dividend payout ratio for 2024 stands at 36.92%, combined with share repurchases accounting for 61.99% of the annual net profit.

Additionally, KEDA Industrial Group launched a new employee stock ownership plan, establishing performance evaluation criteria for 2025-2027 with the ultimate objective of achieving a cumulative year-on-year operating revenue or net profit growth of 340%, based on the 2024 performance.

As one of KEDA Industrial Group's core business segments, the Building Materials Machinery division saw strong performance, benefiting from international expansion and servitization, generalized business extension. The company achieved an operating revenue of RMB 5.605 billion in 2024, marking a year-on-year increase of 25.20%.

During the reporting period, KEDA Industrial Group focused on emerging markets in Southeast Asia, the Middle East, and South Asia, while also expanding into high-end markets such as Europe, resulting in steady growth in international orders.

In spare parts & consumables, the company also saw significant growth in order value, with this segment accounting for 20% of orders in the ceramic machinery business. During the reporting period, KEDA Industrial Group continued to advance its Turkish production base, having set up a local laboratory and ink technology team.

▲KEDA Turkey production base

Furthermore, the annual production lines for 100,000-ton glaze materials and 15,000-ton pigment & glaze of Sinocera Create-Tide have been successfully launched and upgraded. In the area of generalized business, KEDA Industrial Group has continued to expand its product offerings, including aluminum wheel hub forging hydraulic presses and aluminum extrusion machines, achieving breakthroughs in international markets. In 2024, the total order value reached approximately RMB 500 million.

With years of sustained development, KEDA Industrial Group has continuously expanded its building materials production capacity. The company now operates 10 factories across 6 African countries, running 19 building ceramic production lines, 2 sanitaryware lines, and 2 float glass lines.

In 2024, the production of building ceramic products reached approximately 176 million square meters, a year-on-year increase of 17.62%. The Building Materials generated total operating revenue of RMB 4.715 billion, up by 28.99% compared to the previous year.

During the reporting period, new capacity in Africa was gradually released, with the Kenya Kisumu Sanitaryware Factory, Cameroon Building Ceramic Project, and Tanzania Building Glass Project starting production within the year. Meanwhile, the company further enhanced its capacity through strategic mergers and acquisitions expansion, completing the purchase of building ceramic and building glass projects in Kenya and Tanzania respectively.

▲Twyford International launches the first sanitary ware factory in East Africa

Additionally, the company has been implementing production upgrades at multiple building ceramic projects in various regions, with steady progress on the Côte d'Ivoire Building Ceramic Project in Africa and the Peru Float Glass Project in South America.

In 2024, amid prolonged bottom consolidation of lithium prices, Lanke Lithium Industry leveraged its resource endowment, process optimization, and cost control measures to maintain counter-cyclical resilience. Data shows that Lanke Lithium Industry achieved a lithium carbonate production of about 40,000 tons and sales of approximately 41,600 tons, contributing RMB 233 million to KEDA Industrial Group's net profit attributable to shareholders of the listed company.

(Securities Times)

loading...

loading... 29 Mar 2025

29 Mar 2025