In the third quarter alone, KEDA Industrial Group reported revenue of RMB 3.070 billion, with a net profit attributable to shareholders of the listed company of RMB 248 million, and a net profit attributable to shareholders of the listed company excl. non-recurring profit or loss of RMB 236 million, reflecting increases of 4.69%, 73.74%, and 90.18% compared to the second quarter, respectively.

Notably, on October 29, the company’s board approved a share repurchase plan for up to 30 million shares, with a maximum repurchase amount of RMB 300 million, representing 1.56% of the company’s total shares. This move underscores KEDA Industrial Group’s commitment to future development and its emphasis on the secondary market.

| Ceramic Machinery: Building Global Foundations with Generalization and Servitization

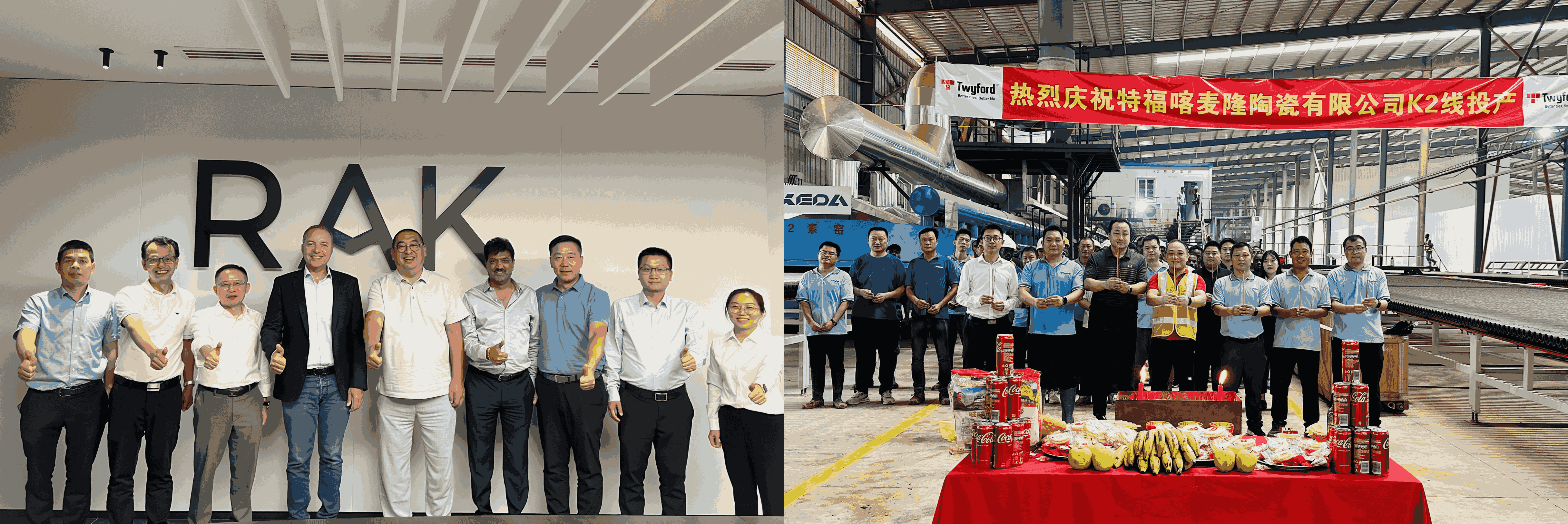

With its long-term globalization strategy, KEDA Industrial Group's ceramic machinery products are sold to over 70 countries and regions. In the third quarter, KEDA Industrial Group focused on expanding its global presence. In the first three quarters of 2024, KEDA Industrial Group’s international orders accounted for 60%, benefiting from the development of global operations, localized services, and brand production lines; it’s maintaining strong order intake and revenue.

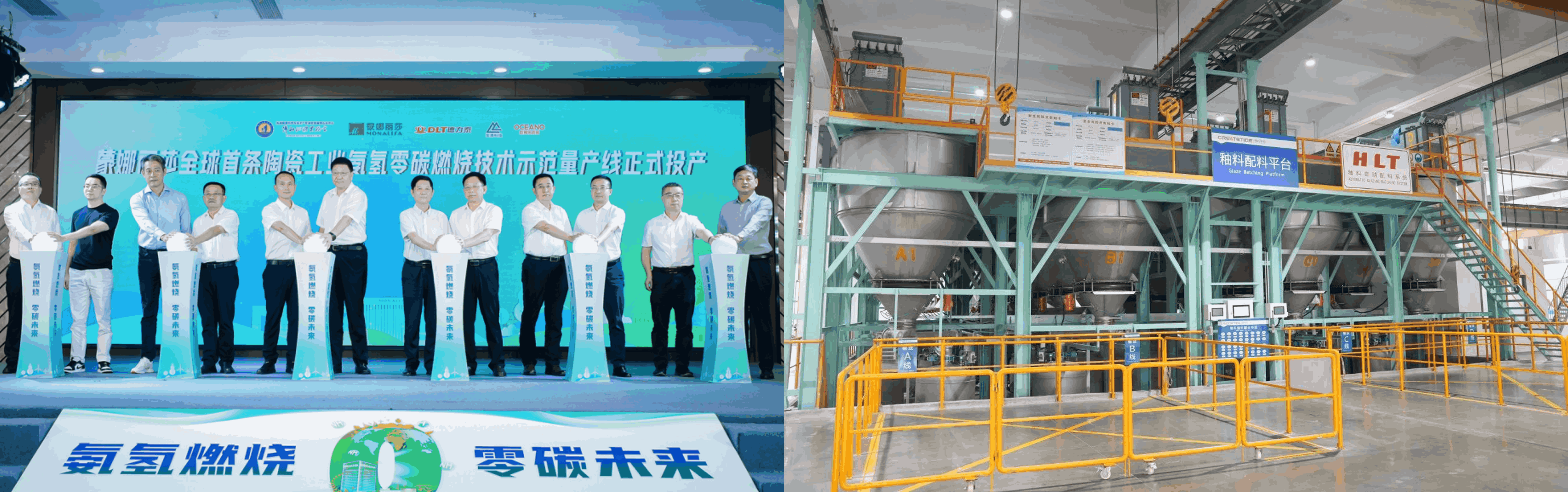

Additionally, KEDA Industrial Group is deepening its generalization and servitization strategies, accelerating its transformation into a "A Global Innovative & Green Solutions Provider for Building Materials & Industry Services ." During the reporting period, KEDA Industrial Group empowered the integration of "Machinery, Spare Parts & Consumables, and Services" and advanced the construction of its Turkey production base and SinoCera Create-Tide's new Foshan base, enhancing localization for customers in global ceramic production areas.

| Building Materials: Strong Capacity Expansion and Deepening International Development

In the third quarter of 2024, KEDA Industrial Group faced some impact from currency depreciation in certain African countries on exchange income and profit margins. However, the company implemented a proactive product price increase strategy, resulting in a quarter-on-quarter increase in gross profit margins.

During the reporting period, KEDA Industrial Group's building materials sector accelerated its expansion worldwide, steadily promoting production line construction and market presence in Africa and the Americas. This progress led to stable growth in both production and sales. Notably, two ceramic production lines in Cameroon commenced operations in July and August, while the Tanzania glass project officially started in September. By the end of the third quarter, KEDA Industrial Group had jointly constructed and operated 19 ceramic production lines, 2 sanitary ware production lines, and 1 glass production line across 6 African countries, with several additional ceramic and glass projects under construction expected to begin production in the coming years.

| Strategic Investment: Lanke Lithium Industry Races to Meet Production Targets, With Q3 Profits Showing Sequential Improvement

Lanke Lithium Industry's profitability remains strong due to continuous production capacity expansion and significant cost advantages. In the first three quarters of 2024, the company produced approximately 30,900 tons of lithium carbonate and sold about 28,300 tons. It achieved operating revenue of RMB 2.219 billion and a net profit of RMB 540 million. Despite a decline in lithium carbonate market prices, Lanke Lithium Industry contributed RMB 235 million in net profit attributable to shareholders of the listed company to KEDA Industrial Group during the same period, ensuring sustained and substantial returns.

(Luo WANG, China Securities Journal News)

loading...

loading... 02 Nov 2024

02 Nov 2024