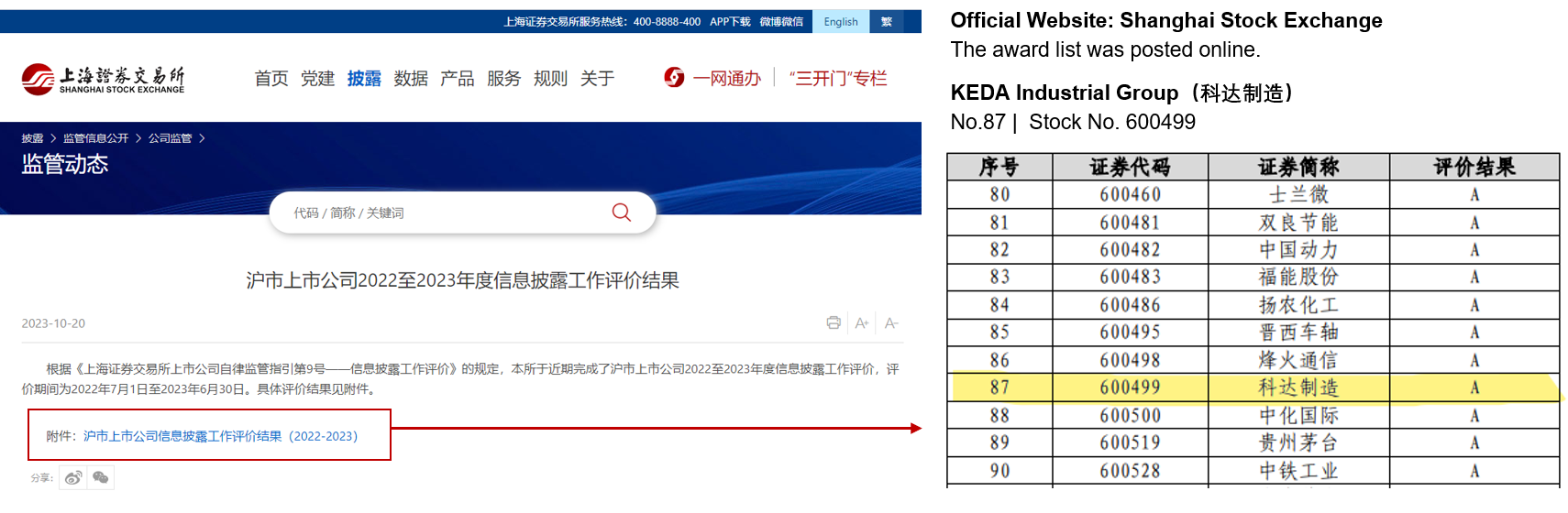

On October 20th, the Shanghai Stock Exchange(SSE) announced the results of the comprehensive evaluation of information disclosure by SSE-listed companies in the 2022-2023 fiscal year. KEDA Industrial Group (600499. SH) once again received the highest "A" grade (excellent) for information disclosure.

In 2023, the Shanghai Stock Exchange implemented comprehensive reforms and refined the rating criteria, further raising the standards for achieving an "A" grade rating. KEDA Industrial Group has received an "A" grade evaluation for information disclosure for two consecutive years, which reflects the ongoing recognition and high praise from regulatory authorities for corporate governance operations, information disclosure, and investor relations management.

In recent years, KEDA Industrial Group has consistently implemented the requirements set by regulatory authorities, such as the China Securities Regulatory Commission on improving the quality of listed companies, adhering to the "four-wheel drive" elements, which include corporate governance, information disclosure, investor relations management, and shareholder returns. These efforts have continuously improved the functions of capital market governance, resource allocation, and value realization.

Fostering Communication, Building Communication Bridges from Multiple Angles

KEDA Industrial Group is well aware that the authenticity, timeliness, accuracy, and completeness of information disclosure have always been a focal point for investors. To facilitate investors in better reading and understanding company announcements, KEDA has consistently worked on enhancing the quality of information disclosure. In regular reports, KEDA dedicates more space to explaining industry conditions, company business model, company position, company strategy, and operational plans. Simultaneously, the disclosed content aims to be concise, clear, and complete. It incorporates visual elements like charts for a more visual presentation. Regular reports and ESG reports are also published in a format that allows investors to grasp the company's highlights quickly.

To further strengthen investor relations and enhance communication, KEDA Industrial Group has provided multiple levels of channels for small and medium-sized investors to understand the company and participate in corporate governance. These channels include investor briefings, on-site research, hotline phone services, a dedicated investor section on the company's website, and interactions on the Shanghai Stock Exchange's E-interactive platform. Additionally, KEDA has established a WeChat Official Account and a WeChat Applet called "KEDA Industrial Group Investor Relations" to regularly deliver company and industry information to investors. KEDA regularly shares updates on the company's daily operations, industry highlights, and institutional research, aiming to facilitate better communication with small and medium-sized investors.

Prioritizing Returns, Sharing Development Dividends from Multiple Dimensions

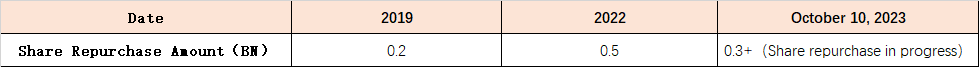

To better safeguard the company's value and shareholders' interests, and in response to market concerns while boosting investor confidence, on September 11th, the KEDA Industrial Group board of directors once again reviewed and approved a maximum share repurchase of 30 million shares. The following day, the company swiftly initiated the repurchase process. As of October 10th, KEDA, through repurchasing special securities accounts in a centralized trading mode, had cumulatively repurchased 26.9745 million shares, representing 1.38% of the total share capital. The highest traded price was RMB 12 per share, the lowest traded price was RMB 10.45 per share, and the total amount paid was RMB 304.9943 million (excluding transaction fees). The repurchase process was executed promptly.

In recent years, KEDA Industrial Group has repeatedly rewarded investors through share repurchases, dividends, and other measures. As of October 10th, KEDA has completed a total of RMB 1 billion in share repurchases. Since its listing, KEDA's total dividends have exceeded RMB 2.8 billion, and historical shareholder returns have reached over RMB 3.8 billion. These actions demonstrate the company's commitment to sharing the dividends of its development with investors, conveying confidence in its growth, and safeguarding the company's value.

KEDA's Past Repurchases

In the future, KEDA Industrial Group will continue to strengthen its internal dynamics, propelling the company to new heights, and better safeguarding the legitimate rights and interests of shareholders, investors, and stakeholders in society. It will play a crucial role in steering the company towards long-term and healthy development.”

(Securities Affairs Department)

loading...

loading... 23 Oct 2023

23 Oct 2023